This is the second in a series of posts about one of the key issues in current GB energy and climate policy: the problems associated with connecting to the electricity grid. The first post, setting out the background to the crisis, is here.

Connections reform took centre stage in a string of government announcements about energy and infrastructure topics in the Chancellor’s Autumn Statement of 22 November 2023. We will cover the connections-related announcements made by the government and Ofgem alongside the Autumn Statement (see further here, here and here) later in this series. In this post, we focus on some key steps that National Grid ESO (NG ESO) took during 2023 to remedy the connections crisis.

Ofgem’s open letter

No single entity can solve the problem of grid connections, but Ofgem has a key role to play. It regulates NG ESO, the owners of the transmission networks, and the distribution network operators (DNOs); it controls in large measure what they can invest through its regulation of network charges; and in most cases it determines whether proposed modifications to industry codes are made. The crisis in connections has featured prominently in recent speeches by Ofgem’s CEO, Jonathan Brearley (such as here).

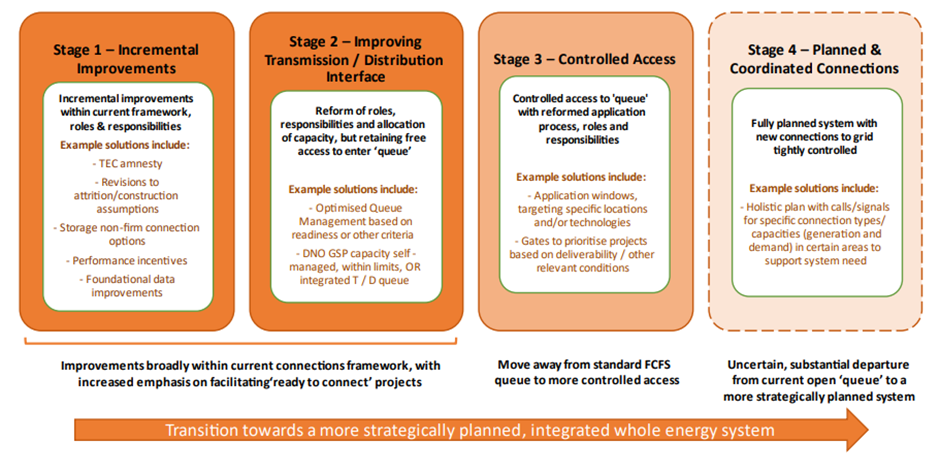

On 16 May 2023, Ofgem published an open letter on future reform to the electricity connections process. It provides a good starting point for considering the ways in which the systemic problem of grid connection is being addressed. Figure 2 of that letter, reproduced below, gives a useful overview.

Ofgem emphasises that any move towards the more radical approaches of Stages 3 and 4 will “depend on the effectiveness of the earlier stages in meeting the outcomes”. It also sets out and elaborates some key principles that will guide its approach.

Reforms must deliver benefits to current and future consumers, as well as accelerating progress towards net zero. They must begin to deliver results as soon as possible, with impacts seen by 2025. They must support improved coordination across onshore/offshore and transmission/distribution networks. They must also be resilient to the impacts of the various wider-ranging energy market and system planning reforms playing out over the remainder of this decade (including the Review of Electricity Market Arrangements (REMA) and introduction of a Future System Operator (FSO), which, as Electricity System Operator, will take over the current roles of NG ESO).

The open letter is a useful recapitulation of action already being taken by Ofgem, such as the “c.£20 billion” Accelerated Strategic Transmission Investment or ASTI framework (see further here), and of possible agenda items for the future (such as “options which could deprioritise projects which are not making progress to allow well-developed projects to proceed“). In this document, at least, the regulator only seems to be systematically promoting “anticipatory investment” (i.e. building ahead of need) in the context of offshore generation projects (see further here).

NG ESO’s short-term actions: the Five-Point Plan

Some of the Stage 1 steps in Ofgem’s graphic feature in NG ESO’s February 2023 Five-Point Plan.

Modelling: how big is the queue (really)?

“Background modelling assumptions” may not sound terribly exciting, but they play a crucial role in the connection process. In order to be robustly connected to the network, each generating project may require “wider works”, not just the construction of infrastructure in their immediate vicinity. The current list of transmission reinforcement schemes required to facilitate network connections runs to well over 4,000 projects, most with delivery dates in the late 2020s or early 2030s.

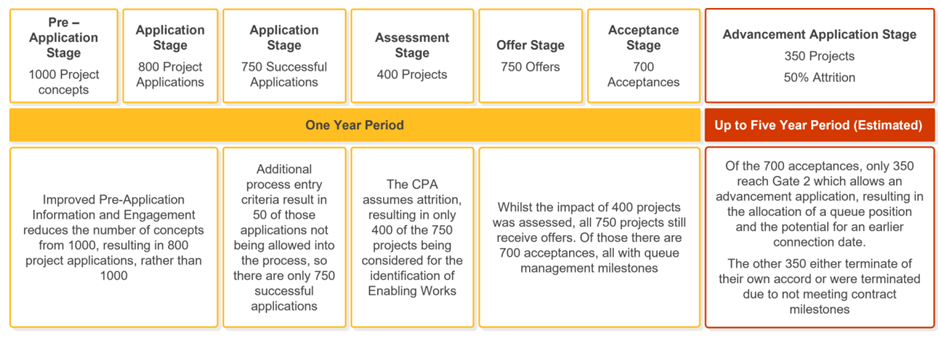

The need for and phasing of wider works can have a significant impact on a project’s connection date. Both inevitably depend in part on what work is required to accommodate other projects that are seeking to connect. Elsewhere, NG ESO has pointed out that 42% of new applications for connection made between 2018 and 2021 had “fallen out of the process” by December 2022, and it has been estimated that as much as 30-40% of capacity in the current transmission queue may not be ready to connect on its scheduled connection date (if it is built at all).

Clearly, if an appropriate way can be found of taking account of the level of “attrition” in the connections queue, it may be possible to accelerate the connection of some projects.

NG ESO is therefore “working with GB’s Transmission Owners to review and update existing contracts with…new Construction Planning Assumptions“. It should be possible to manage these changes through existing System Operator-Transmission Owner Code and Connection and Use of System Code (CUSC) procedures. NG ESO states that implementation will require a “complete system review of the GB Transmission Reinforcement Works…for all contracted offers with a connection date post 1 January 2026“, at the end of which “some contracted parties within the GB transmission system queue…could have their connection date moved forward“.

The current estimate is that 46GW of projects could accelerate their connection dates as a result.

These modelling changes (and those specifically relating to storage – see below) are feeding into a “complete system review” of Transmission Reinforcement Works (TRW) for all projects with a connection date after 1 January 2026. This will “rationalise the TRW required” and identify options for battery projects to connect earlier with interim restrictions (see below).

Storage

Separately, NG ESO has also changed its approach to determining the impact of new storage (in particular, battery) projects on the system – recognising that the inherently two-way relationship between a storage project and the grid can mean that its presence reduces, rather than increases, the need for network reinforcement upstream of the point at which it is connected to the grid.

The Five-Point Plan is also looking at the terms on which storage projects are connected, as outlined in a policy paper published in June 2023. It is a bit like a storage-specific version of “Connect and Manage” (see the previous post in this series), but with at least one significant difference.

NG ESO recognises that accelerating the connection of storage capacity can have system benefits as well as bringing “a potential risk that under certain conditions, the real-time behaviour of such projects increases operational costs“. So, on the one hand, storage projects will be able to connect before certain “non-[safety-]critical enabling works have been carried out” but, on the other hand,”there will be certain operational scenarios such as when it is windy and storage is contributing to the local constraints where we may pull them back even if the network is intact“. There will also be no compensation for the storage projects that are subject to such curtailment.

The new offer is to be embodied in new contractual drafting and available to those connecting either to a transmission or a distribution network. An initial tranche of transmission connected battery storage customers (with a combined capacity of some 10GW) will connect on an interim non-firm basis an average of four years ahead of their firm connection dates.

Two-step offer process

However, it is not only storage projects that will see changes to their connection offers. For at least a year from 1 March 2023, NG ESO is splitting the connection offer process into two stages. An initial offer containing no detail of the works involved or any “securities” (i.e. amounts payable by the generator), but guaranteeing the project a “place in the queue” once accepted, will be followed (within nine months of acceptance) by a follow-up offer with all the details normally found in transmission connection offers that were “missing” from the initial offer.

The intention seems to be, at least in part, to buy time for NG ESO to apply the new modelling assumptions discussed above. The process will work in a slightly different way in Scotland. The detailed FAQs document suggests that the industry has had a number of questions about all this.

Jumping out of the queue…

In June 2023, NG ESO stated that, of some 40GW of projects that were due to connect to the transmission network before 2026 (numbering 220 in total), only half had planning consent and some had moved their connection dates back by more than 14 years. This is unfortunate, but not surprising.

Projects often apply to connect to the network (in particular, the transmission network) as one of the first steps that they take, years before they have obtained planning consent. Subsequently, difficulties in obtaining planning consent are one of a number of reasons why they may then not be able to build out in time to be connected at the date anticipated in their connection offer.

However, transmission-connected projects in particular tend to be slow to give up their connection rights rather than merely adjusting their target commissioning dates. A developer that terminates its connection agreement may need to go to the back of a very long queue if it later wants to re-establish its project. There are also adverse financial consequences to terminating, or reducing a project’s transmission entry capacity (TEC) under the standard form agreements that developers enter into with NG ESO, incorporating as they do the cancellation charges regime in Section 15 of the CUSC.

NG ESO’s Five-Point Plan addresses this by means of a “TEC Amnesty” (launched in September 2022). However, the amount of capacity released by this process, though useful, is not game-changing (8.1GW of projects initially expressed interest in the Amnesty; some have since withdrawn, and it looks as if, ultimately, about 4GW of capacity will be removed from the TEC register).

…or being pushed

In 2021, NG ESO proposed a CUSC modification which would allow it to manage its connections queue more actively, by terminating contracted projects not progressing against agreed milestones to free up space for those which are. Although not formally part of the Five-Point Plan, it is closely related to it, aiming to curb use of the Modification Application process to keep connection agreements artificially alive by delaying their completion dates. The proposed modification was approved by Ofgem on 13 November 2023, with an implementation date of 27 November 2023.

In future, projects will be held to a series of eight milestones. Failure to meet some of them will result in automatic termination (subject to exceptions for force majeure etc) and failure to meet others will give NG ESO discretion to terminate. The new regime will apply to new agreements and to projects whose contracted completion date is two years or more from 27 November 2023; or less than two years from that date but which NG ESO consider are not progressing satisfactorily.

From 27 November 2023, NG ESO will issue “all customers who hold live construction agreements with a completion date post-November 2025, with a notice with two options; either to have queue management milestones applied to their current completion date or submit a modified application for a new completion date where queue management milestones will be applied“.

Queue management is expected to have a much bigger impact, perhaps ultimately removing about 80GW of projects currently on the TEC register.

NG ESO’s longer-term plans for connections reform

The Five-Point Plan is just a start. In 2022, NG ESO began an extensive programme of engagement with the industry about ways of overhauling the connections application process in the longer term.

In June 2023, NG ESO published its proposals (full suite of associated documents available here). In the best traditions of significant changes in the sector, they have at their heart a new acronym – in this case, TMO4. In December 2023, NG ESO published its “final recommendations” following the consultation (full report here, summary here, webinar recording here and slide deck here

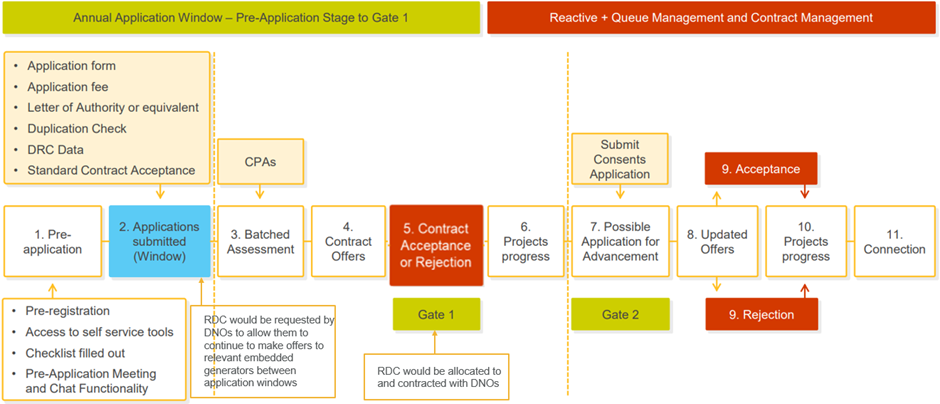

We have combined below two versions of NG ESO’s diagram summarising TMO4.

One of a series of options considered by NG ESO and stakeholders, TMO4 moves us towards Stage 3 in Ofgem’s overview table above, but stops decisively short of Stage 4. NG ESO sees the potential benefits of moving away from an essentially generator-led approach. However, it sees a shift to an entirely “centrally-planned” approach (in which generators would be expected to bring forward projects to fit around the development of the transmission network rather than the other way around) as something that would need to be mandated by “government, Ofgem and other key decision-makers”, taking account of relevant wider changes such as the ongoing REMA process.

The central idea is a (probably annual) cycle of “batched assessment” of connection applications by NG ESO (or, as it will be then, FSO – hereafter ESO). The idea is that by considering a batch of new applications together, the network design for them can be developed in one piece. A secondary application process at Gate 2 would then allow projects that can build out earlier to seek accelerated connection. The period to the left of the first vertical dashed line is estimated as lasting three months and the period between the two vertical dashed lines is estimated as lasting six months.

A further diagram offers another picture showing how the phenomenon of “attrition” (noted above), and ESO’s modelling of it, might play out against the new process (with illustrative numbers).

Broadly speaking, although the consultation elicited a number of responses that differed substantially from NG ESO’s preferred options either in terms of overall approach or on points of detail, the approach NG ESO proposes in the near term is closely aligned with that set out in the consultation.

At the same time, the consultation process has to some extent been slightly overtaken by government and Ofgem policy publications issued during November 2023 (see here, here and here). Partly for this reason, and partly because of stakeholder feedback and the evolution of NG ESO’s own thinking, it would appear that, in some respects, NG ESO’s approach may evolve on some points, so that the immediate outputs from the consultation process may be more of a staging post on a longer journey than a final destination. An example is whether the queue is formed at Gate 1 or Gate 2. NG ESO is sticking with Gate 2 for now, but clearly has not closed its mind to the alternative.

Other areas that will be subject to further consideration, starting during the “Phase 3” period of implementation (starting in January 2024), but a final position on which is not necessarily expected to form part of TMO4 when it first goes live, include the following.

- A possible move towards shorter or more frequent application windows.

- Alternative requirements for what is submitted (particularly in relation to consents) at Gate 2.

- Quite a number of issues relating to the transmission/distribution interface, where DNOs are invited to identify Reserved Developer Capacity (RDC) in respect of embedded generation projects of between 1MW and 100MW capacity in England and Wales but only up to 30MW in the South and up to 10MW in the North of Scotland (although the possibility of raising the Scottish limits will continue to be explored in Phase 3). See in particular pages 23-25 of the final recommendations report. Meanwhile, RDC is to be renamed Distribution Forecasted Transmission Capacity (DFTC), which is considered a more accurate description.

- Interactions with other processes in which holding a connection agreement is important. These include the Capacity Market regime and the Network Services Procurement (Pathfinders) – which also raises the more general question of how the reformed connections process may interact with the competitive appointment of transmission owners (either OFTOs or transmission owners for onshore projects appointed under the changes made by the Energy Act 2023).

- The criteria to be used by NG ESO in rejecting applications for a new connection offer or to modify an existing agreement – which may include that they conflict with government or regulatory policy, including as embodied in a future Strategic Spatial Energy Plan (SSEP).

- The introduction of “use it or lose it” arrangements to ensure that projects fully utilise their contracted capacity once connected.

There is a fair amount of work still to be done to implement the final recommendations, not least the proposal, processing and approval by Ofgem of modifications to the CUSC and other industry codes (which, subject to Ofgem approval, would be processed on an “urgent” basis). The aim is that all of this – or, at least, enough of it to deliver a minimum viable product (MVP) version of the new process – will be accomplished during 2024, so that it can be launched at the start of 2025.

Implementation has already begun, with the proposal in December 2023 of a CUSC modification to require that new onshore transmission connection applications must be accompanied by a “letter of authority” (LoA) confirming “that the project developer has…formally engaged in discussions with the landowner(s) in respect of the rights needed to enable the construction of the developer’s project on their land” or demonstrating “that the project developer is the landowner(s)“. Pending the outcome of the modification process, customers will be “encouraged” to provide an LoA on a voluntary basis.

The LoA proposals are one of a number of elements set out in the consultation as “Target Model Add-Ons” (TMAs). Chapter 3 of the final recommendations report indicates which of these NG ESO is minded to pursue, and whether they are to form part of the MVP (as in the case of the LoA) or not (as in the case of proposals TMA D5 and D6, relating to standardisation of connection offer terms).

One area said to fall within the MVP is likely to be the subject of continuing debate: TMA F sets out the criteria that could be used to accelerate projects that fulfil specified criteria. NG ESO reports “majority stakeholder support” for fast-tracking projects with official government designation (TMA F1); otherwise demonstrating “significant additional consumer, net zero and/or wider economic and societal benefits” (TMA F2); or that are “ready(ier) to connect” (TMA F3), but this is subject to the obvious caveat that the basis for identifying them must be “clearly defined, consistent and transparent” (including as regards relative priority between projects in these three groups).

The report promises “further clarity” on TMA F1 to F3 and recommends that a mechanism which would allow some projects simply to pay to be accelerated (TMA F4) “should not be progressed at this time”. It also indicates that such acceleration will depend on capacity first being freed up as a result of contract terminations or other outputs of the new queue management process.

Developers will no doubt welcome being given access, “by end-March 2024”, to a range of tools to facilitate their planning, including an enhanced TEC register and Transmission Works Register, and an interactive map providing capacity and application data to a substation level of granularity.

One of the reasons for choosing TMO4 is its alignment with the connection process for offshore projects. NG ESO recommends that it should in future apply to them, with some modifications to reflect the different processes that apply to the granting of “land rights” offshore.

External governance of the detailed design and implementation of the final recommendations will be provided by a Connections Process Advisory Group (CPAG). CPAG will replace the existing Connections Reform Steering Group and will have “an independent chair and broad representation from across industry“. NG ESO has published draft terms of reference for CPAG.

Looking beyond TMO4, NG ESO notes that, while existing initiatives are addressing four out of five of the areas that are key to delivering the overall objective of quicker connection to and use of the transmission system in a more coordinated and efficient way, “in some cases, the level of impact of these initiatives is lower than we might hope, or the time to deliver impact is longer…because either the initiative only benefits new applicants, or because [its] impact…dampened or deferred…by the significant numbers of new projects…joining the connections queue“. Moreover, “none of the current initiatives are actively targeted at supporting an efficient transition to the new…connections process“.

To address this, the final recommendations report puts forward five “indicative packages” of further measures and some potential additional actions to support efficient transition. These are as follows.

- Package 1 comprises “low regret options/enablers” relating to guidance for projects on connecting to the transmission or distribution network; potential changes to charging for smaller embedded generation at local grid supply points; better sharing of transmission and distribution queue data; introduction of contestability into the design and delivery of transmission connections; and reallocation of bays (including existing bays) at substations.

- The measures in Package 2 would require a further Transmission Works Review, “which will take time” and focus on changing network modelling tools and assumptions to reduce the amount of network reinforcement required, enabling more projects to connect quickly. They range from extension of elements in existing initiatives to more significant changes, such as “introducing a new definition of enabling works [into the Connect and Manage regime], perhaps accompanied by changes to access arrangements for project developers, such as potentially moving away from the concept of a guaranteed firm connection“.

- In Package 3, NG ESO considers ways to “re-order/re-size the current connections queue in 2024, as a stepping stone to potential future arrangements under the SSEP from 2025 onwards“. The idea would be to find a way to set a threshold for contracted projects, either by technology type, or by auction across all technology types, so that those “below” the threshold retain their current (or an accelerated) connection date (or, where the threshold has yet to be met, are allocated a date in the normal way) and those above it are placed in a “‘stack’ or ‘waiting room’ outside of the queue“. Projects would only “exit the stack” if additional capacity below the threshold opened up (e.g. because projects still in the queue are terminated or the threshold is reset) and they could demonstrate that they are viable and ready to progress. This is difficult territory, but Package 3 could obviously make a significant impact.

- Package 4 is also about re-ordering/reducing the queue. Packages 3, 4 and 5 are seen as mutually exclusive (but individually compatible with Packages 1 and/or 2). It overlaps with ideas put forward in the Connections Action Plan. Options include a one-off window in which projects could “trade queue positions and/or capacity with each other” much more freely than is currently possible; ramping up application fees, user commitment fees, or capacity holding charges as a way of weeding out “speculative” or otherwise less viable projects; and a more “proactive” approach to queue management than is currently proposed.

- Package 5 would combine elements of Packages 3 and 4 by “shar[ing] additional information with the market with a view to providing clear signals to project developers…and then facilitating ‘queue swaps’ under a centrally administered process“. Any project that benefited from a swap would also be expected to take on any associated burdens (“queue management milestones and user commitment/liabilities of the project it has swapped with“).

- The potential additional actions proposed are reducing the amount of engineering work done in relation to connection offers before TMO4 goes live (essentially, not including all the wider enabling works), and closing the connections process to new applications for a period of, say, three months before the go-live date.

NG ESO proposes to move ahead with Package 1 in any event (while noting that parts of it are contingent on regulatory decisions). It sees any implementation of Packages 3 to 5 as requiring decisions to be made by Ofgem or government, and any decision on Package 2 as needing to be taken in the context of any decision on Packages 3 to 5.

In short, the publication of the final recommendations of NG ESO’s connection reform consultation marks a significant step in addressing the GB connections crisis but, at the same time, implementing its recommendations will be a major task over the next year or so, and will not be the end of the story.