A decade of delivery…

On 18 July 2024, Energy Secretary Ed Miliband made a statement to Parliament on the new government’s “clean energy superpower mission”, which includes “zero carbon electricity by 2030”. Early on, he referred to the UK’s Climate Change Committee’s annual “progress report”, which was published the same day.

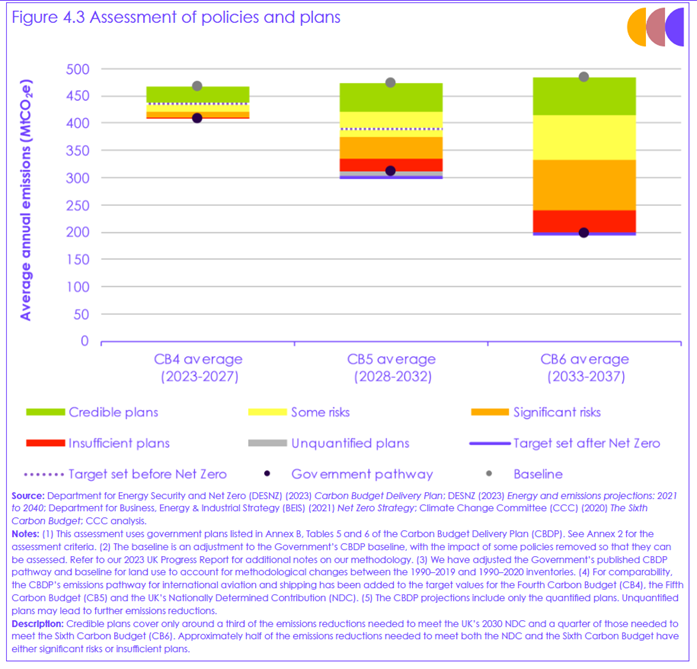

The stand-out graphic from the report (below) emphasises the CCC’s concerns about the credibility of the previous government’s policies and plans to deliver the next two five-yearly carbon budgets.

The targets underlying the CCC’s assessments are the less ambitious ones set by the previous government (e.g. aiming to decarbonise power supply in 2035). The CCC’s findings that the UK was “slightly” or “significantly” off track in half of the areas where progress is required are all the more urgent from the perspective of the new government’s desire to decarbonise faster and further.

It is little comfort that, in decarbonising too slowly, the UK is to a large extent reflecting global trends (as analysed, for example, in the 2024 edition of BP’s Energy Outlook a few days earlier).

The CCC’s “top ten” policy recommendations to get back on track are generally unsurprising.

- Most call for regulatory actions (e.g. reinstating the date for phasing out fossil-fuel vehicles, getting the design of CfDs right for the next allocation rounds).

- At least one (“introduce a comprehensive programme of decarbonisation for public sector buildings”) poses an interesting challenge for a new government keen to demonstrate the power (and value for money) of public-private partnership.

- Two (on “engineered removals”, and on trees and peatlands) emphasise the importance of removing CO2 from the atmosphere, as well as avoiding CO2 emissions in the first place.

The CCC’s full report and accompanying documents are here; for an excellent summary see here.

Flying start

New Ministers have not been short of advice on energy and climate change priorities. A few days before the CCC report was published, another to-do list arrived in the form of Aviva Investors’ thorough and detailed “policy roadmap” on Boosting Low Carbon Investment in the UK.

The new government took a step recommended by both Aviva and the CCC on 8 July 2024 by removing the effective block on onshore wind farms in England getting planning permission.

A day later, the government announced the appointment of former CCC chief executive Chris Stark to head the “control centre” to co-ordinate the mission to decarbonise the grid by 2030. AFRY, in a report for OEUK, have since outlined what it is likely to take, in infrastructure terms, to achieve that goal.

On 17 July, the King’s Speech, announcing an extensive programme of government Bills in the first session of the new Parliament, highlighted several items relevant to the energy sector (see here).

- A Great British Energy Bill will begin the process of establishing Great British Energy. With an initial capitalisation of £8.3 billion, this publicly owned developer, owner and operator of energy sector assets will facilitate, encourage and participate in clean energy projects, the reduction of energy sector GHGs and improvements in energy efficiency. It is also intended to “oversee the biggest expansion of community energy in British history”. (See further the subsequently published “founding statement” for GBE and other documents here.)

- A Crown Estate Bill will enable the Crown Estate, which already has a central role in the UK offshore wind sector as the landlord of the seabed, to borrow and to invest in a wider range of companies and projects that will support the development of that sector.

- A Sustainable Aviation Fuel (Revenue Support Mechanism) Bill will aim to accelerate the commercialisation of SAF by providing a revenue certainty mechanism for those seeking to produce it in the UK and meet the demand for SAF stimulated by an obligation on aviation fuel suppliers to have at least 10% SAF in the fuel they supply to airlines.

- A National Wealth Fund will be established, with an initial budget of £7.3 billion, building on the work of the UK Infrastructure Bank, to invest directly in priority sectors as part of the government’s “industrial strategy and growth” and “clean energy superpower” missions.

- Speeding up consents for electricity networks and other energy infrastructure will be a key focus of the Planning and Infrastructure Bill, as it attempts to shorten the seemingly ever-lengthening timescales for determining applications in respect of major infrastructure projects.

- The development and maintenance of energy networks and other infrastructure will also be facilitated by the National Underground Asset Register, which is to be put on a statutory footing by a Digital Information and Smart Data Bill.

- The safety, accuracy and efficiency of products placed on the UK market that use or measure energy is regulated by what were originally EU rules. The Product Safety and Metrology Bill, aiming to support growth, provide regulatory stability and protect consumers, will allow the government to “mirror or diverge from updated EU rules” without primary legislation.

- The current cyber security regulations, on the other hand, which are also of EU origin and relate to energy and other sectors, are to be updated by a Cyber Security and Resilience Bill.

- Like other sectors where growth may be constrained by a shortage of skilled labour, the energy sector should benefit from the new institutional framework of the Skills England Bill.

- No doubt there is an expectation that the Pension Schemes Bill will benefit energy projects as it “enables pension schemes to invest in a wider range of assets, driving growth”.

UK energy policy could not be more prominently placed. The aims are clear. With energy security, climate change and the growth agenda all in the frame, the stakes could scarcely be higher.