This is the first in a series of posts about one of the key issues in current GB energy and climate policy: the problems associated with connecting to the electricity grid. Connections reform took centre stage in a string of government announcements about energy and infrastructure topics in the Chancellor’s Autumn Statement of 22 November 2023 (see further here, here and here).

We will examine the steps being taken or proposed to remedy the current problems with connections in later posts, but it seems worth beginning by looking at why we have a problem in the first place.

Introduction

Once upon a time, developers of new electricity generation projects in GB looked on with a touch of smugness when colleagues working in other jurisdictions complained about the difficulty of achieving timely grid connections. Those days are long gone. For some time now, GB grid connection difficulties have been firmly in the spotlight as an obstacle both to individual projects and wider policy goals.

Scale

The scale of the problem is readily apparent from National Grid ESO’s connections registers. The register of projects with contracts for Transmission Entry Capacity (TEC) (including both “directly connected” and “embedded” projects) as of 19 November 2023 showed the following.

- Some 73GW of capacity already “built” was listed as having TEC. This was spread across approximately 300 projects, about half of this capacity being fossil-fuelled generation.

- Alongside this existing capacity, there appeared to be more than 1,200 new or proposed projects (some in the same location as each other), with a total capacity of some 405GW. Most of these involved renewable generation, storage or a mixture of the two.

- Only 8.5GW of the new or proposed projects were listed as “under construction/commissioning”; 27GW were said to have “consents approved”; 55GW to be “awaiting consents”; but more than 75% (314GW) were said to be only at the “scoping” stage.

The vast majority of new capacity represented by the figures in the TEC table is for new generation or storage. From the perspective of a GB electricity system that currently has an installed generating capacity of just over 100GW, it is tempting to think that proposals for more than 400GW of new capacity are no more than overheated speculation. No doubt, not all the projects on the TEC register will ultimately be built, but bear in mind that many have connection dates in the 2030s and that, under the most progressive of the scenarios in the 2023 edition of NG ESO’s Future Energy Scenarios, the amount of new installed capacity required by 2035 is probably at least 200GW.

Symptoms

The GB transmission system operator, National Grid ESO (NG ESO), provided a useful statement of the challenges that new capacity faces in its December 2022 report, GB Connections Reform: Case for Change. This begins by acknowledging a “common consensus…that the current connections process is no longer fit for purpose”. The statistics that highlight a system in crisis include:

- a tenfold growth in the number of new application offers from 2018 to 2022, with the volume of offers for Q1 2023 exceeding that for the whole of 2022;

- more than 40% of new applications being withdrawn, rejected or terminated, and almost 60% of contracted applications undergoing modification (often more than once);

- of those offered connections over the 12 months to May 2023, 70% were given connection dates at least five years in the future and more than 25% received dates after 2032 – dates that, in most cases, are significantly later than those that the developers would have chosen.

These figures relate to the transmission system, to which, at the end of 2021, just over 66% of GB electricity generation capacity that was directly connected to public networks was connected. However, it is not just many of the projects with transmission connection agreements that are unable to connect as soon as they would like. Many of those seeking to connect to one of the 14 regional networks operated and owned by a licensed distribution network operator (DNO) face similar issues.

In addition to NG ESO’s December 2022 report, these problems have been highlighted by a recent Parliamentary Select Committee report on Decarbonisation of the power sector, by a very useful Regen report and by the Independent Report of the Offshore Wind Champion, Tim Pick.

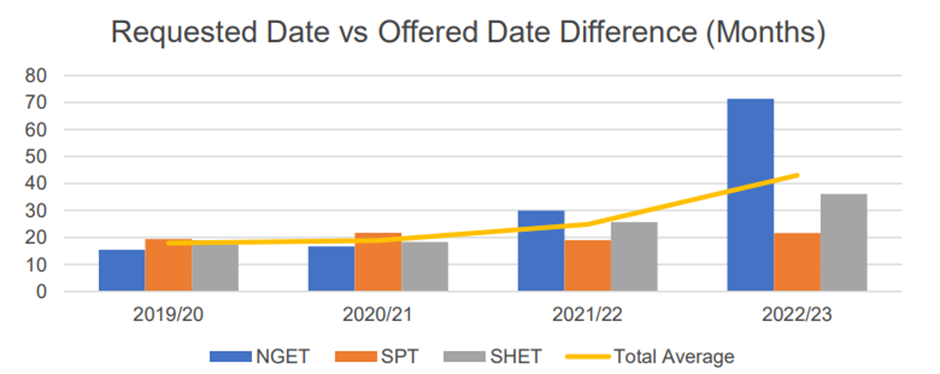

Most recently, NG ESO’s June 2023 Connections Reform Consultation has provided the following graphic, which speaks for itself.

It is also worth noting that the problems of insufficient network capacity inhibit both sides of the market: demand, as well as supply. Developers of commercial and industrial property, even those who are trying to “do the right thing” by installing onsite generation (which will sometimes export), find that the absence of available grid connection capacity is holding back their projects.

Causes

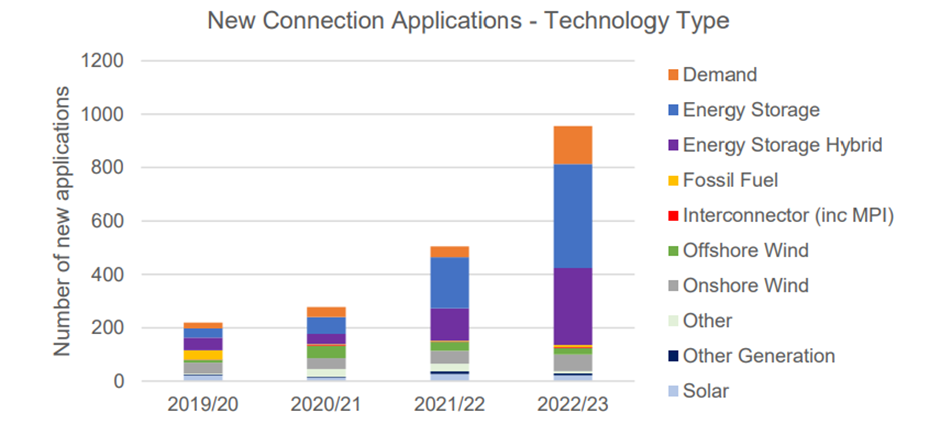

How did we get here? Partly, it is just a question of a system struggling to deal with a massive increase in requests for connection, often to serve large amounts of generation in areas where little or no electricity has previously been generated. Another graphic from NG ESO’s June 2023 consultation, below, shows the increasing height of this wave.

However, it is also true that the systems that are having to deal with the current huge volume of connection requests are not well adapted to handle it.

The processes for obtaining a connection offer at either transmission or distribution level are distinct but inter-related. They are highly standardised, and operate within parameters laid down by a mixture of primary legislation, licence conditions and industry codes established under those conditions. (NG ESO has an extremely helpful webpage that summarises the key documents and how they interact, as well as providing access to them. The DNOs also publish useful guidance about their processes.)

Below, we look at some of the systemic factors that have contributed to the connections crisis.

A generator-led system

- Broadly speaking, and subject to various qualifications, developers of generation or storage projects are entitled to request a connection for as much capacity as they want, where they want it and the network operators are obliged to plan their development around those requests. They have little or no ability to “just say no” – although they can, and often do, say “not for a while”.

- Historically, Ofgem, in controlling the amounts that networks can charge users (and therefore spend on investment in strategic development of the network), has been reluctant to let them build significantly in anticipation of generators’ specific requests and needs. The general approach has been closer to “build it when they come”, than “build it and they will come”, or even “built it where they are likely to come”. The “it” in question may be significant upgrading of the grid in an area where, because of the availability of renewable resources, it is likely that a significant amount of new capacity will, sooner or later, need to be connected. An example of this is the 180km of new transmission line proposed in the East Anglia GREEN project.

- The system’s historic ability to cope with the increase in connected capacity arising from the growth of renewables, at least at transmission level, has depended to a large extent on the “Connect and Manage” policy. This was first introduced in 2009 and has allowed much new generation capacity (particularly Scottish onshore wind) to connect before the network had the capacity to cope with its output all of the time (in effect, “build some of it after they’ve come”).

- Connect and Manage enabled renewable capacity to expand rapidly and may have reduced the immediate burden on consumers of paying for new infrastructure. However, it comes with a cost – most obviously, in the form of increasingly sharp increases in the Balancing Services Use of System (BSUoS) charges that users pay NG ESO for keeping the system in balance. These reflect (amongst other things) its costs of paying those whose projects sit in areas behind “constraint boundaries” on the transmission system not to generate/export power at times when the network cannot handle the output of all those who would like to export power in such an area (e.g. when the wind is blowing or sun is shining strongly). The more generation is “constrained off” the system, the higher the BSUoS charges.

- Striking a balance between the desire not to burden consumers with what may not be immediately necessary infrastructure costs and enabling the energy transition to play out as quickly and efficiently as possible over the system as a whole is not easy. There may be room for debate as to whether the right choices were made in 2009 and subsequently, but now Ofgem itself is calling time on Connect and Manage. In a paper published in March 2023, it states a preference for “programmatic grid expansion…in line with top-down system plans prepared by the Future System Operator (FSO), in anticipation of generation and demand”. This would make future grid expansion more similar to what happened in the previous periods of major GB network and generation expansion during the 20th century (e.g. the construction of the Supergrid after 1950).

A fragmented system?

- The process of providing new projects with connection capacity, whether “generator-led” or “top-down”, is to some extent complicated by the structure of the GB transmission sector.

- The “onshore network” infrastructure assets are owned by Scottish and Southern Electricity Networks (SSEN) in the north of Scotland, Scottish Power Transmission (SPT) in the south of Scotland and National Grid Electricity Transmission (NGET) in England and Wales.

- Connections to individual offshore wind farms are owned (so far, invariably acquired post-construction) by individual offshore transmission owners (OFTOs). (Some of the “onshore network” is partly offshore, in the form of submarine cable “bootstraps”, providing additional connectivity between generators in Scotland and electricity consumers in England and Wales.)

- Co-ordinating the efforts that owners of different parts of the onshore network may need to make to enable projects to connect, NG ESO provides the interface between transmission owners and project developers. The processes by which it does this are governed by the System Operator Transmission Owner Code (STC) (as regards NG ESO/transmission owner relations) and the Connection and Use of System Code (CUSC) (as between NG ESO and project developer).

- Like most GB energy industry codes, the CUSC and STC are the product of many years’ logical thought by highly expert practitioners. They can seem fairly impenetrable to the uninitiated. Some readers may feel they have a tendency to hide key points in unexpected places or subsidiary documents. In many ways, they work very well, but the system is not without in-built frictions.

First come, first served

- Again, this is not an absolute rule, but applications for connection are generally processed in the order in which they are received and, where capacity for connecting new generation is constrained, there is limited scope to re-assign it from an earlier to a later applicant.

- One consequence of this is that later projects with a greater potential to be built out in the short term may find themselves assigned far-off connection dates because existing capacity (or new capacity that will become available sooner) is reserved for the use of applicants who applied for and received their connection offers earlier. This is so even if they are much less likely to be built, having become, more or less, “paper projects” (e.g. because the original application was highly speculative, or market conditions or the project’s individual circumstances have changed).

- At best, there are limited incentives for developers that hold connection offers to relinquish those that they are unlikely to use – indeed, they often face a significant penalty if they do so.

Elements of uncertainty

- The process of initially obtaining an offer can often be complicated by the so-called Statement of Works process – where the requirements of one project, in combination with others, trigger a need to reinforce the transmission network, introducing further costs and delays.

- Although such an arrangement is at some level inevitable, its practical application in individual cases often catches projects by surprise. This is particularly true for projects whose immediate connection is with the distribution, rather than the transmission network, but whose operation is nevertheless likely to have impacts on transmission network capacity (with the DNO, rather than the developer, managing the interface with NG ESO). In some cases, it appears that the Statement of Works process is triggered after the project has received a connection offer.

- To cover for such eventualities, the standard terms of DNO connection offers always include some important caveats. Clause 4 of the standard terms used by UKPN, the London and South-East England DNO, is typical: it includes a right for the DNO to vary the connection offer (including the connection date) if “at any time before or during the carrying out of the distribution network operator’s (DNO) works, any part of the DNO’s works or their means of execution is affected by…reinforcement works required to the Transmission System“.

Conclusions

The current system has been overwhelmed and is no longer fit for purpose. Its operation can hamper both the efficient development of the network and growth in new capacity by undermining the value of their connection offers. This is holding back new renewable/other low carbon generation, as well as storage and other projects that can enhance system security and flexibility.

Necessary as it may be for the network operator to have some ability to introduce variations, too much flexibility can mean that the connection offer, a document that is typically used to underpin financing and other aspects of project development, starts to lose legal certainty, with obvious implications for the developer’s ability to progress the project. This, in turn, may lead to the project becoming one of the “paper projects” clogging up the system.

The good news is that these problems are now well understood and being addressed. We will look at what is being done to relieve the connections crisis in subsequent posts.