Things may be starting to move a bit faster in the world of GB energy policy after what you could be forgiven for thinking was a Brexit-induced slowdown. On 24 July 2017, the UK government’s Department for Business, Energy and Industrial Strategy (BEIS) and the energy regulator Ofgem published a number of documents that reveal their evolving thinking about the future of the GB electricity system. These publications followed on from some significant initiatives by Ofgem and National Grid. This is the first of series of posts assessing where all this activity may be leading.

The full holiday reading list from 24 July was as follows.

- The centrepiece was the BEIS / Ofgem response to the joint “call for evidence” on a “smart, flexible energy system” that they issued in November 2016 (CFE). As well as the response itself (the Response), there is a “smart systems and flexibility plan” (the Plan), ending with a helpful summary of the current state of play and next steps.

- Alongside the Response and the Plan, BEIS publicised some significant funding initiatives for battery technology under the umbrella of the government’s industrial strategy, on which the Secretary of State for BEIS, Greg Clark, gave a speech in Birmingham.

- The final contribution from BEIS was the innocuously titled “Capacity Market: improving the Framework” (the CM Consultation).

- Ofgem set out its “views on the design of arrangements to accommodate independent aggregators in energy markets” (the IDA policy paper), supported by an “assessment of the economic value of demand-side participation in the Balancing Mechanism and an evaluation of options to improve access” from Charles River Associates (the CRA Report).

- At the same time, Ofgem published work by Cambridge Economic Policy Associates on the distributional impacts of time of use tariffs (the CEPA Report).

- Finally, an Ofgem update and a launch statement and other documents kicked off a Significant Code Review on mandatory half hourly metering (the SCR Papers).

Other recent official publications that are relevant in this context and referred to below include:

- Ofgem’s “Impact Assessment and Decision on industry proposals…to change electricity transmission charging arrangements for Embedded Generators” (the TDR Decision);

- Ofgem’s consultation on a targeted review of network charging (the TCR Consultation);

- National Grid’s consultation on the evolution of balancing services markets in GB, entitled “System Needs and Product Strategy” (SNaPS) and available here;

- National Grid’s “Future Energy Scenarios 2017” document (FES 2017), available here.

- The 2017 Report to Parliament – Meeting Carbon Budgets: Closing the policy gap from the Committee on Climate Change (CCC), as part of the supporting research to which the CCC published a Roadmap for Flexibility Services to 2030, prepared by Pöyry and Imperial College London (the Pöyry / Imperial Report).

Overview

The Response and the Plan cover a broad range of subjects; many of the other documents are rather more monothematic. We will follow the topic headings in the Response, referring to the other documents where they are relevant. However, it is helpful to start by framing some of the key themes underlying this area of policy by turning to the Pöyry / Imperial Report.

The CCC has recommended that in order to achieve the ultimate objective of the Climate Change Act 2008 (reducing UK greenhouse gas emissions by 80% by 2050), the carbon intensity of the power sector should fall from 350 gCO2/kWh to about 100 gCO2/kWh by 2030. Pöyry / Imperial observe that in any future low carbon electricity system, “we should anticipate:

- a much higher penetration of low-carbon generation with a significant increase in variable renewable sources including wind and solar and demand growth driven by electrification of segments of heat and transport sectors;

- growth in the capacity of distribution connected flexibility resource;

- an increased ‘flexibility’ requirement to ensure the system can efficiently maintain secure and stable operation in a lower carbon system;

- opportunities to deploy energy storage facilities at both transmission and distribution levels; and

- an expansion in the provision and use of demand-side response across all sectors of the economy.

System flexibility, by which we mean the ability to adjust generation or consumption in the presence of network constraints to maintain a secure system operation for reliable service to consumers, will be the key enabler of this transformation to a cost-effective low-carbon electricity system. There are several flexibility resource options available including highly flexible thermal generation, energy storage, demand side response and cross-border interconnection to other systems.”.

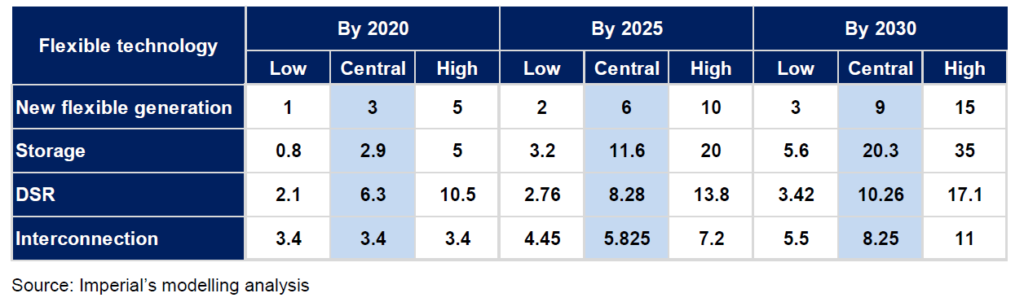

This explains why technologies and mechanisms that can increase system flexibility are a dominant theme in current GB electricity sector policy-making. But Pöyry / Imperial then go on to discuss the extent of the uncertainty that, based on their modelling, they consider exists about how much the main types of flexible resource may be needed on the way to achieving the CCC’s target. This is clearly shown in the table, reproduced below, setting out their assessment of “the required range of additional capacity of different flexible technologies to efficiently meet 2030 carbon intensity targets”.

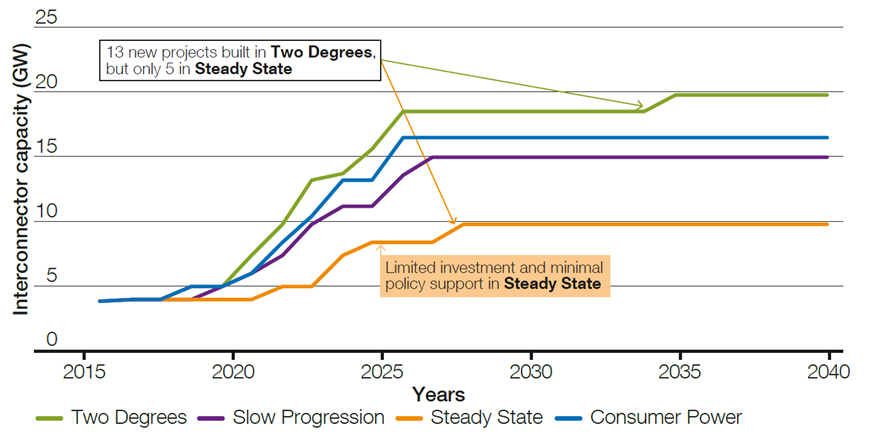

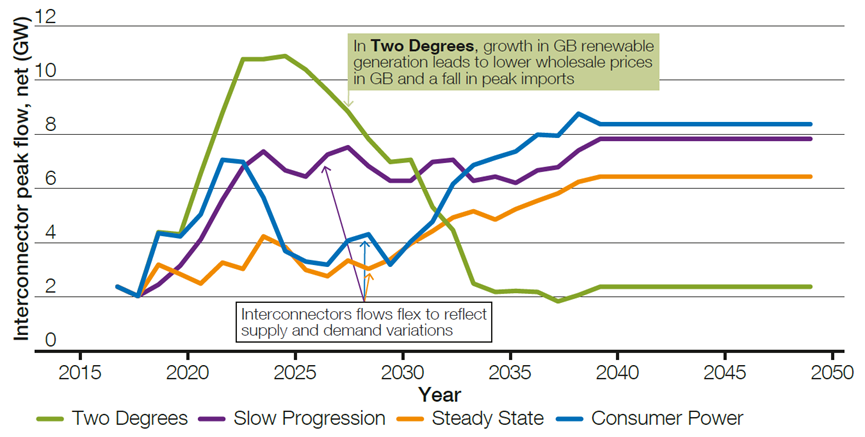

With the exception of interconnectors, the table shows the amounts of each flexible technology in the low and high scenarios, at each of the three dates, varying by a factor of 5 or more. As regards interconnectors, an illustration of the potential uncertainties in the different scenarios modelled by National Grid in FES 2017 is provided by the two FES 2017 charts below.

Source: National Grid, FES 2017

Source: National Grid, FES 2017

The need for more flexible resources is clear, and Pöyry / Imperial calculate that integrating them successfully, as compared to the use of “conventional thermal generation based sources of flexibility”, could save between £3.2 billion and £4.7 billion a year in a system meeting the CCC’s 2030 target. But it is also clear that there are many different possible pathways that could be followed to achieve this level of flexibility, and that even if we get to 100 gCO2/kWh by 2030 – which is by no means guaranteed – there will inevitably be, at least relatively speaking, “winners” and “losers” in terms of which flexible technologies, and which individual projects, end up taking a greater or lesser share of what could be loosely called the “flexibility market”.

What will determine who wins or loses out most in this competition will be the same factors as have driven changes in the generation mix in the UK and elsewhere in recent years – in particular, the interplay of regulation and technological change. In 2016, as compared with 2010, the UK consumed 37% less power generated from fossil fuels and more than twice as much power generated from renewable sources: see the latest Digest of UK Energy Statistics. That shift is the result of subsidies for renewable generating capacity and reductions in the cost of wind and solar plants combined with other regulatory measures that have added to the costs of conventional generators. But whereas in the initial stages of decarbonising the generating mix, the relationship between regulatory cause and market impact has been relatively straightforward, making policy to encourage flexible resources is more complex: it is like a puzzle where each piece put in place changes the shapes of the others.

This is perhaps why the actions recommended by Pöyry / Imperial as having a high priority, summarised below, all sound difficult and technical, and require a large amount of collaboration.

| Pöyry / Imperial recommended high priority actions for the flexibility roadmap (emphasis added) | ||

| Action | Responsible | Time frame |

| Publish a strategy for developing the longer-term roles and responsibilities of system operators (including transitional arrangements) that incentivises system operators to access all flexibility resource by making investments and operational decisions that maximise total system benefits. | Ofgem in conjunction with industry | 2018 |

| Periodical review of existing system planning and operational standards for networks and generation, assessing whether they provide a level-playing field to all technologies including active network management and non-build solutions (e.g. storage and DSR), and revise these standards as appropriate. | Industry codes governance and Ofgem | Initial review by 2019 |

| Review characteristics of current procurement processes (e.g. threshold capacity level to participate, contract terms / obligations) and the procurement route (e.g. open market, auctioning or competitive tendering) that enable more efficient procurement of services without unduly restricting the provision of multiple services by flexibility providers. | Ofgem in conjunction with SO, TOs and DSOs | By 2020 |

| Assess the materiality of distortions to investment decisions in the current network charging methodology (e.g. lack of locational charging, double-charging for stored electricity), and reform charging methodology where appropriate. | SO, DSOs and Ofgem | By 2020 |

| Assess the materiality of distortions to investment decisions in the absence of non-network system integration charging (i.e. back up capacity and ancillary services) and implement charging where appropriate | SO, DSOs and Ofgem | By 2020 |

| Publish annual projections (in each year) of longer-term future procurement requirements across all flexibility services including indication of the level of uncertainty involved and where possible location specific requirements, to provide greater visibility over future demand of flexibility services | SO and DSOs | 2020 onwards |

Storage

We looked at the current issues facing the UK energy storage sector and recent market developments in some detail in a recent post, so we will not dwell too much on the background here.

Storage – conceptually if not yet in practice – is the nearest thing there is to a “killer app” in the world of flexible resources. It has the potential to be an important asset class on a standalone basis, but it can also be combined with other technologies (from solar to CCGT) to add value to them by enabling their output to match better the requirements of end users and the system operator.

In GB, as in a number of other jurisdictions, there is intense interest in developing distributed storage projects based on battery technology (for the moment at least, predominantly of the lithium ion variety), and a strong focus on doing so in a way that allows projects to access multiple revenue streams. There is also a general feeling that the regulatory regime needs to do more to recognise storage as a distinct activity but at the same time to do less to discriminate against it in various ways.

So, what do the Response and the Plan tell us about the vision for storage?

- The Response points to National Grid’s SNaPS work, “which specifically considers improving transparency and reducing the complexity of ancillary services”.

- It also points to work that has been done and/or is ongoing to clarify how storage can be co-located with subsidised renewable electricity generating projects and to provide guidance on the process of connecting storage to the grid. BEIS / Ofgem note that they see no reason why a network operator should not “promote storage…in a connection queue if it has the objective of helping others…to connect more quickly or cheaply”, and point out that Ofgem can penalise DNOs who fail to provide evidence that they are engaging with and responding to the needs of connection stakeholders.

- BEIS / Ofgem highlight the proposals in the TCR Consultation on reducing the burden faced by storage in terms of network charges, notably the removal of demand residual charges at transmission and distribution level, and reducing BSUoS charges, for storage. A response to that consultation is to be published “in the summer”.

- In relation to behind the meter storage, BEIS / Ofgem observe that at present: “technology costs and the limited availability of Time of Use (ToU)/smart tariffs are greater barriers…than policy or regulatory issues”. This may invite the response from some readers that it is precisely a matter for policy and regulation to promote time of use / smart tariffs: the CEPA Report makes interesting reading in this context.

- BEIS / Ofgem “agree with the view expressed by many respondents” that network operators should be prevented from directly owning and operating storage” whilst slightly fudging the extent to which this may already be the case as a result of existing EU-based rules on the unbundling of generation from network operation, but “noting” the current EU proposals in the November 2016 Clean Energy Package to prohibit ownership of storage by network operators except in very limited circumstances and with a derogation from the Member State.

- Flexible connections “should be made available at both transmission and distribution level”.

- BEIS / Ofgem agree that the lack of a legal definition or regulatory categorisation of storage is a barrier to its deployment. Legislation will be introduced to “define storage as a distinct subset of generation”. This will enable Ofgem to introduce a new licence for storage before the changes to primary legislation are made. The “subset of generation” approach will also “avoid unnecessary duplication of regulation while still allowing specific regulations to be determined for storage assets” – such as whether the threshold for requiring national rather than local planning consent should be the same for storage as for other forms of generation.

- The prospect of storage facilities benefiting, as generation, from relief from the climate change levy is also noted – although since the principal such relief (for electricity generated from renewable sources) no longer applies, this may be of limited use to most projects.

What the Response says about storage is typical of its approach to most of the issues raised in the CFE. If one wanted to be critical, it could be said that although, on the whole, BEIS / Ofgem engage with all the points raised by stakeholders, there is rarely an immediate and decisive answer to them: there is always another workstream somewhere else that has not yet concluded that holds out the prospect of something better than they can offer at present. On the other hand, perhaps that just highlights the points implicit in the Pöyry / Imperial Report’s recommendations: no one body can by itself create all the conditions for flexibility to be delivered cost-effectively, and it will be difficult fully to judge the success of the agenda that BEIS and Ofgem are pursuing for another two or three years.

But wait a minute. On the same day as it issued the Response and the Plan, BEIS also published the CM Consultation. The sections of the Response on storage say nothing about this document, but it is potentially the most significant regulatory development in relation to storage for some time.

- The Capacity Market is meant to be “technology neutral”. Above a 2 MW threshold, any provider of capacity (on the generation or demand side) that is not in receipt of renewable or CCC subsidies can bid for a capacity agreement in a Capacity Auction that is held one year or four years ahead of when (if successful) they may be called on to provide capacity when National Grid declares a System Stress Event.

- A key part of the calculations of any prospective bidder in the Capacity Market, particularly one considering a new build project, who is hoping that payments under a capacity agreement will partly fund its development expenses, is the de-rating factor that National Grid applies – the amount by which each MW of each bidding unit’s nameplate capacity is discounted when comparing the amount of capacity left in the auction at the end of each round against the total amount of capacity to be procured, represented by the demand curve. Some of the de-rating factors applied in the 2016 T-4 Auction are set out below.

| Technology class | Description | De-rating Factor |

| Storage | Conversion of imported electricity into a form of energy which can be stored, the storing of the energy which has been so converted and the re-conversion of the stored energy into electrical energy. Includes pumped storage hydro stations. | 96.29% |

| OCGT / recip | Gas turbines running in open cycle fired mode. Reciprocating engines not used for autogeneration. |

94.17% |

| CCGT | Combined Cycle Gas Turbine plants | 90.00% |

| DSR | Demand side response | 86.88% |

| Hydro | Generating Units driven by water, other than such units: (a) driven by tidal flows, waves, ocean currents or geothermal sources; or (b) which form part of a Storage Facility. | 86.16% |

| Nuclear | Nuclear plants generating electricity | 84.36% |

| Interconnectors | IFA, Eleclink, BritNED, NEMO, Moyle, EWIC, IFA2, NSL (project specific de-rating factors for each interconnector) | 26.00% to 78.00% |

- In the table above, storage has, for example, a de-rating factor approximately 10 percentage points higher than DSR and hydro and, if successful at auction, would receive correspondingly higher remuneration per MW of nameplate capacity than those technologies.

- The typical potential storage project competitor in the Capacity Market is now more likely to be a shed full of batteries than a pumped hydro station. This has prompted industry participants to question whether such a high de-rating factor is appropriate to all storage. Ofgem, in considering changes to the Capacity Market Rules proposed by stakeholders, declined to take a view on this, deferring to BEIS.

- BEIS, in the CM Consultation, finds merit in the arguments that (i) System Stress Events may last longer than the period for which a battery is capable of discharging power without re-charging; (ii) batteries degrade over time, so that their performance is not constant; (iii) a battery that is seeking to maximise its revenues from other sources may not be fully charged at the start of a System Stress Event. It proposes to take these points into account when setting de-rating factors for the next Capacity Auction (scheduled to take place in January 2017, and for which pre-qualification is ongoing), and splitting storage into a series of different categories based on the length of time for which they can discharge without re-charging (bands measured in half-hourly increments from 30 minutes to 4 hours). Bidders will be invited in due course to “self-select” which duration-based band they fall into.

- Of course, deterioration in performance over time is not unique to batteries – other technologies may also perform less well by the end of the 15 year period of a new build capacity agreement than they did at the start. And, as with other technologies, such effects can be mitigated: batteries can be replaced, and who knows by what cheaper and better products by the late 2020s. However, a fundamental difficulty with the CM Consultation is that it contains an outline description of a methodology, based around the concept of Equivalent Firm Capacity, but no indicative values for the new de-rating factors.

- It may be that BEIS’s concerns about battery performance have been heightened by the fact that the parameters for the next Capacity Market auctions show that it is seeking to procure an additional 6 GW of capacity in the T-1 auction (i.e. for delivery in 2018). There is reason to suppose that battery projects could make a strong showing in this auction, given their relatively quick construction period and the number of projects in the market, some of which may already have other “stacked” revenues (see our earlier post). Clearly it would be undesirable if a significant tranche of the T-1 auction capacity agreements was awarded to battery storage projects which then failed to perform as required in a System Stress Event.

- It is arguable that the three potential drawbacks of battery projects are not necessarily all best dealt with by de-rating. For example, the risk that a battery is not adequately charged at the start of a System Stress Event is ultimately one for the project’s operator to manage, given that it will face penalties for non-delivery. Nor is it only battery storage projects that access multiple revenue streams and may find themselves without sufficient charge to fulfil their Capacity Market obligations on occasion: pumped hydro projects do not operate only in the Capacity Market, and even though they may be able to generate power for well over four hours, they too cannot operate indefinitely without “recharging”. Moreover, National Grid is meant to give 4 hours’ notice of a System Stress Event, which may provide battery projects with some opportunity to prepare themselves.

- However, the real objection to the de-rating proposal is not that it is not addressing a potentially real problem, but that it is only doing so now – given that the issue was raised by stakeholders proposing Capacity Market Rules changes at least as long ago as November 2016 – and with no published numbers for consultees to comment on.

- The de-rating proposal illustrates a fundamental feature of the flexible resources policy space: one technology’s problems provide an up-side for competing technologies. Self-evidently, what may be bad news for batteries is good news for other storage technologies to the extent that they are not perceived to have the same drawbacks.

- Seen in this light, the CM Consultation appears to be the main (perhaps only) example of a policy measure that supports the “larger, grid-scale” storage projects (using e.g. pumped hydro or compressed air technology) about which the Response has relatively little to say. However, a few percentage points more or less on de-rating may not make up for the lack of e.g. the “cap and floor” regulated revenue stream advocated by some for such projects.

In Part 2 of this series we will focus on the role of aggregators (featuring the analysis in the CRA Report on independent aggregators) and the demand-side more generally.