In a series of announcements on 17 December 2015, the UK Government has almost completely answered the question it posed in a series of consultations in July and August 2015: how to minimise, and then stop, any further subsidies to the UK solar industry. The headline points are as follows.

- As proposed in its consultation of 22 July 2015, the Government has decided to close the Renewables Obligation (RO) to new solar PV plants of <5 MW from 1 April 2016.

- There will be a grace period until 31 March 2017 for projects that had progressed to the stage of meeting specified criteria relating to preliminary accreditation or “significant financial commitment” (accepted grid connection offer, planning application and land rights) by 22 July 2015, or subsequent grid connection delays.

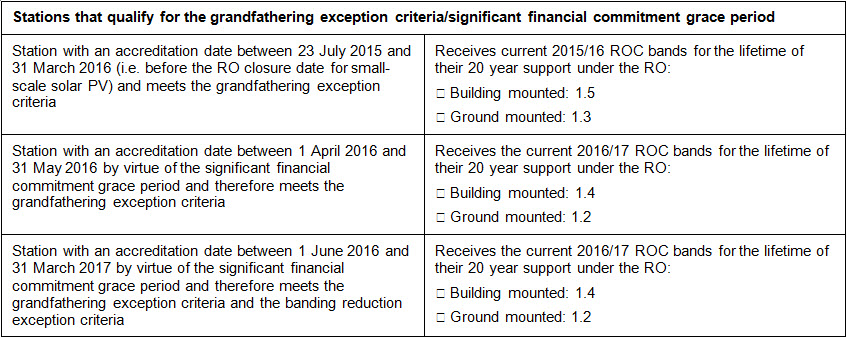

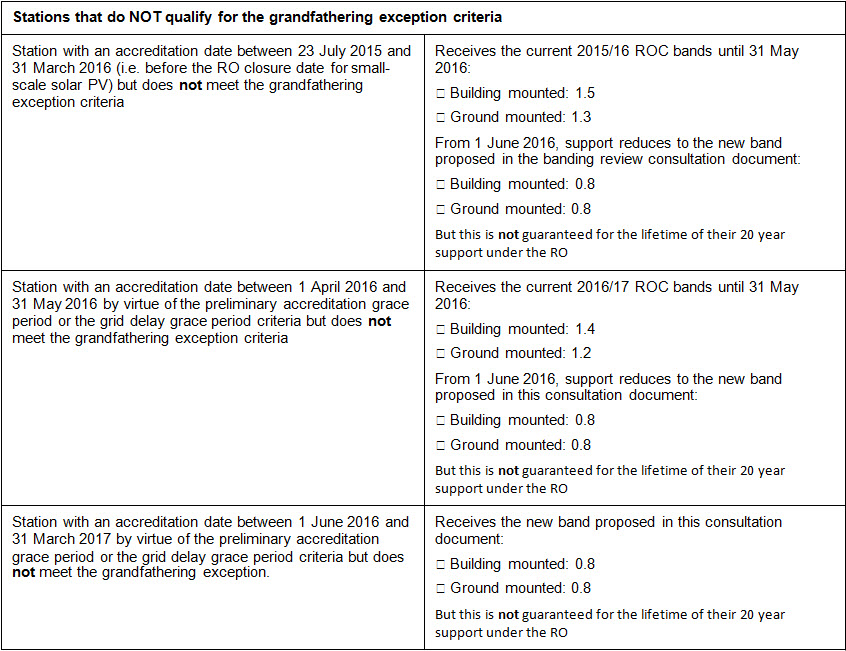

- The Government is proposing a change in the level of ROC banding with effect from 1 June 2016, such that projects with an accreditation date after 22 July 2015 would receive 0.8 ROC / MWh rather than their previous levels of 1.5 or 1.4 (for roof-mounted projects) or 1.3 or 1.2 (for ground-mounted projects).

- Projects that had not satisfied the “significant financial commitment” criteria by 22 July 2015 will not necessarily benefit from the same level of RO support (0.8 ROC from 1 June 2016) over the 20 year period of their eligibility for Renewable Obligations Certificates (ROCs) – i.e. the policy of “grandfathering” will not apply to them and their ROC support could be reduced at any time.

- The Feed-in Tariff (FIT) scheme will be reformed broadly in line with the consultation proposals of 27 August 2015 – that is, the tariffs for most technologies and installation sizes will be significantly reduced, future deployment under the scheme will be tightly limited, and the overall administration of the scheme will become more complex.

One point on which the 17 December announcements do not elaborate is whether any future allocation process for Contracts for Difference (CfDs), which are intended to replace the RO for most eligible technologies, will include solar projects. More on that below. DECC has also left the door open to, or positively indicated that it will, make further reforms in 2016.

We set out below some further points to note in respect of each of the 17 December announcements and some thoughts about where all this is, or may be, going. For background, particularly on FITs, see our earlier blog post on the FIT reform proposals.

Renewables Obligation changes

It is hard to imagine what any consultees could have said to persuade the Government not to close the RO to new <5 MW solar projects a year before the general RO closure date of 31 March 2017.

Government concern about breaching the limits on renewables subsidies set out in the Levy Control Framework (LCF) runs very deep. The Impact Assessment suggests that early closure will save the LCF between £60m and £100m. This is on the assumption that those plants that qualify for grace period treatment are unlikely to need to rely on it (perhaps likely in most cases except where it is an unforeseen delay in the grid connection that qualifies the project for grace period treatment). However, the Impact Assessment is also even-handed enough to note that the LCF savings could be counter-balanced by the negative value of CO2 emissions not avoided as a result of losing 1.2 to 2.0 GW of new solar generating capacity that might otherwise have been constructed.

The Government appears to have been concerned that if it were not for the removal of grandfathering and the banding review, projects that did not enjoy grace period treatment (some of them perhaps projects failing to accredit at current FIT generation tariff levels and seeing 1.3 or 1.2 ROC as an attractive fall-back) would have come forward and been accredited before 31 March 2016 – in numbers that would have been prejudicial to the LCF limits: “the spike of deployment of solar projects of greater than 5 MW at the end of the last financial year demonstrates the solar industry’s ability to react quickly and decisively to changes in the policy environment”. If there is no similar spike in <5 MW RO projects in the current financial year, it will probably be because by consulting in July on both the removal of grandfathering and the possibility of a banding review, but only announcing in December what the level of post-banding review ROC support might be, the Government created a climate in which the majority of prudent solar developers would not consider pursuing, in the intervening period, projects that did not meet the significant financial commitment criteria.

It is to be hoped that investors will perceive the removal of grandfathering in this case as a tactical manoeuvre by a Government that believed it faced a unique problem. If, instead, investors were to form the view that what has happened in this case heralds a general departure from the policy of grandfathering renewables subsidies that has been almost universally adhered to by the UK to date, they would obviously be more reluctant to commit to UK renewables projects in future.

A sizeable minority of consultees agreed that costs have reduced since the last banding review (and about half of them thought the reductions significant). Many also cited plausible reasons why – notwithstanding e.g. the fall in panel prices – the Government should not take the strike price for solar projects set in the first CfD auctions earlier this year (£50 and £79.23 / MWh) as necessarily representative of the typical costs of an RO-supported solar project. However, the Impact Assessment for the banding review consultation, supported by an Arup study, suggests that 0.8 ROC / MWh is not a prohibitively low level of subsidy for some projects and industry players.

As the banding review and grandfathering changes only affect projects in England and Wales the trend of increasing interest in Scottish projects is likely to continue. Northern Ireland will also continue to enjoy different bandings.

Clarification of what is required to satisfy the planning component of the significant financial commitment grace period criteria has been provided in a draft of the Order that will implement the early closure of the RO to <5 MW solar projects. This may well terminate the viability of some projects whose promoters hoped to obtain grace period treatment in cases where something less than what constitutes a valid application under the relevant planning legislation had been submitted to the local planning authority by 22 July 2015.

The combined effect of the decisions on early closure and grandfathering, coupled with the proposed banding review changes, is well summed up in the following tables from DECC.

FIT reforms

The FITs changes affect smaller-scale onshore wind and hydro projects as well as <5 MW solar projects. The starting point is clear from the first page of the Impact Assessment for the FITs announcement: “The intention is that a maximum of £100m is spent on new-build deployment per year over this FITs review period (from early 2016 to the end of 2018/19).”.

If it achieves this, the Government expects to reduce LCF costs by between £380m and £430m, reduce deployment by between 5.6 GW and 6.2 GW (or between 802,000 and 912,000 fewer installations) and see between 9,700 and 18,700 fewer jobs in the solar industry by 2020/21.

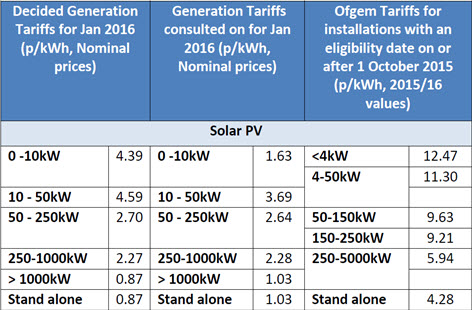

The principal means of securing these results are severe cuts in generation tariff rates. The DECC table below shows how the new rates for solar PV projects compare with those currently in force, and those proposed in the August 2015 consultation.

It is the smallest installations, representing domestic roof-mounted solar, which have done best out of the consultation process, but it is those in the 250-1000 kW bracket that will see the lowest reductions in subsidy. Good news for commercial and industrial premises with lots of roofspace and a significant daytime electricity demand on-site – even if the consultation process has led to 0.01p/kWh being trimmed from their proposed tariff. (The cuts to wind and hydro tariffs are somewhat less severe, but still swingeing in many cases.)

The Impact Assessment and response to consultation together are more than 150 pages long. Blog posts are meant to be short and pithy, so there is not space here to mention everything that is of interest in the FITs announcement. However, the following points are worth noting.

- The consultation response confirms that support under each tariff band will be subject to quarterly rationing (“deployment caps”). For the largest bands this may mean that only one or two installations are accredited in each quarter. Everything will depend on the date and time (“to the second”) of an installation’s MCS certificate or ROO-FIT application. Those who miss out in one quarter will be “frozen” in a queue until the next cap opens.

- There is a lot of detail on the working of the caps and the reformed degression mechanism in the consultation response (see also Ofgem’s draft guidance).

- Pre-accreditation, removed as long ago as 1 October 2015, is to be re-introduced (for those installations to which it was previously available – i.e. not including those of <50 kW) but in an attenuated form: installations will get the tariff rate that applies on the date of their accreditation, not that of their pre-accreditation.

- Some of the post-consultation tariff adjustments reflect changes in what the Government considers to be appropriate target hurdle rates (now 4.8% for solar). These may not be enough to motivate those who are thinking of installing domestic rooftop solar.

What happens next?

RO

The early closure of the RO to <5 MW solar will be implemented by amendments to the Renewables Obligation Closure Order 2014. The banding review proposals, if taken forward after the current consultation ends on 27 January 2016, will need to be implemented by amendments to the Renewables Obligation 2015, by 1 June 2016.

The statutory instruments required to make both sets of changes will require the approval of both Houses of Parliament – which, although likely, cannot be guaranteed, particularly in the case of the House of Lords, who recently voted down the proposed early closure of the RO for onshore wind.

FITs

Implementing the policy decisions on FITs requires a combination of modifications to the standard conditions of electricity supply licences and amendments to the Feed-in Tariffs Order 2012. Differences in Parliamentary procedure mean that the licence modifications take longer to bring into force than the amending Order. Accordingly, Government expects the Order to come into effect on 15 January 2016 and the licence modifications (which include the new tariff rates) to come into effect on 8 February 2016. As mentioned briefly in the FITs consultation, there is to be a pause in the FITs accreditation process between 15 January and 8 February 2016.

As in the case of the RO changes, there is (at least in theory) scope for a negative vote in either House of Parliament to blow the implementation off course. It would also be surprising if there were not some attempts to challenge the changes by way of judicial review, although the litigation process would inevitably play out over a slower time-frame.

And there is more to come…

The Government has expressly flagged or left open a number of areas of possible further reform. For example, the feedback received on possible changes to the FIT export tariff “will be used to frame a detailed consultation on these issues in the future” – Government “may make changes to the structure of the export tariff…for new entrants [including] changes to indexation”.

And just in case anybody should feel too comfortable, the new tariffs, the system of deployment caps and the overall scope of the FITs scheme (i.e. whether it should be more tightly focused in terms of technologies or sizes of installation) are all to be kept under review.

What about CfDs (and everything else)?

The original reason for closure of the RO is its replacement by CfDs, the costs of which, because they are allocated in a competitive process and using defined budgets, can be more easily be controlled. The expectation was that CfD allocation rounds and Capacity Market auctions would be (at least) annual events. However, whilst the Government has held a second Capacity Market auction a year after the first such auction, more than one year on from when the first CfD auction process began, there is no sign yet of the process for a second CfD auction being set in motion. And although one has been announced in general terms as taking place in 2016, there has been no definite pronouncement as to whether it will include a budget for solar.

Is the Government waiting to see how the new ROC band and FIT tariffs play out before deciding whether to include solar in the next CfD auction, and/or how much money to allocate to the part of the auction where solar projects will compete? The rules allow the Secretary of State to decide these points only a very short time before the allocation process begins. For developers considering whether to commit significant sums of money to progress potential solar CfD projects to the stage where they could bid in a 2016 auction, the lack of clarity about such an auction is not helpful.

The FITs consultation response says that it contains measures that “seek to maintain a viable renewables industry which, in the longer-term, can continue to reduce its costs, seeking to achieve grid parity”. By the Government’s own admission, that industry, if still viable, will be considerably smaller once these reforms have been implemented. It is to be hoped that the industrial and commercial rooftop sector will continue to expand, given the relatively less severe FIT tariff rate reductions that are to be imposed on it. It is likely that some business will be lost to other European jurisdictions which currently enjoy a more benign solar subsidy environment.

Away from the narrow focus on subsidy costs, the hottest strategic topic about the growth of solar deployment is how to manage the system integration costs of low carbon technologies (particularly intermittent wind and solar generation) and encourage the use of storage by renewable generators so as to smooth their export profile and increase system flexibility. (See also Ofgem’s position paper of 30 September 2015 on system flexibility.) These issues were essentially absent from the consultation proposals and decisions. However, the FITs consultation response states that DECC is engaging closely with Ofgem and stakeholders to identify barriers to the deployment of storage and are considering potential remedial actions. The Government plans to consult on this work in “spring 2016”. Perhaps less advantageously for the solar industry, Government is also “continuing to explore” with National Grid and Ofgem the question of “distributed generation paying for its impact on the whole system”.

Another interesting year ahead for an industry which learnt some time ago that the only certainty is change.