As a share of UK electricity generation, renewables increased tenfold between 2004 and 2019. The various forms of public financial support provided to the sector played a major part in this. Government policy is now targeting an even more spectacular increase in the production of low carbon hydrogen in the UK over the next 10 years. Once again, subsidies will be crucial.

In this post, and the next one, we discuss the UK government’s recently published plans for financial support to the low carbon hydrogen sector. These are set out in Consultation on a business model for low carbon hydrogen (BM Consultation) and Designing the Net Zero Hydrogen Fund Consultation (NZHF Consultation). Both documents were published by the Department of Business, Energy and Industrial Strategy (BEIS) on 17 August 2021. For general background, a full list of the other hydrogen policy documents published on the same date and a discussion on BEIS’s overarching Strategy, click here. For a post on the related consultation on standards, click here.

Background

The hydrogen business model and NZHF aim to help low carbon hydrogen production projects overcome a number of barriers: high production costs (relative to alternative, high-carbon (“counterfactual”) fuels); technological and commercial risk; uncertain demand for their product; lack of an established market structure (in sharp contrast to renewable electricity); lack of distribution and storage infrastructure; and policy and regulatory uncertainty (at least, prior to 17 August 2021).

The hydrogen business model would do this by giving projects revenue support during their operational phase. The NZHF would provide capital support, likely in the form of grants payable on the completion of certain milestones. These two schemes are complemented by BEIS’s evolving industrial carbon capture business model, which may support investment in carbon capture retrofitting of existing “grey” (rather than new “blue” or “green”) hydrogen capacity.

BEIS takes the view that both forms of support (revenue and capital) are needed. It also considers that other relevant interventions that could boost demand for low carbon hydrogen (such as broader and sharper carbon pricing) would not be adequate on their own to secure the future of the low carbon hydrogen sector. It sees the central functions of the business model as addressing:

- market price risk (the risk that the price a producer can get for its hydrogen in the market does not cover its production costs); and

- volume risk (the risk that the producer cannot sell enough hydrogen to cover its costs: for example, because its customers go out of business, move or switch supplier).

In designing the business model and NZHF, BEIS is mindful that the hydrogen value chain is both nascent and complex; that the value of hydrogen varies considerably between different potential end user groups; and that methane reformation is less flexible than electrolytic production.

In the remainder of this post, we look at BEIS’s overall view of the proposed hydrogen business model and at how it proposes to address market price risk. In the next post, we will look at how the business model would address volume risk, and other aspects of the proposals, including how support under the business model would be allocated to individual projects.

What kind of scheme should the hydrogen business model be?

BEIS says that it would prefer the hydrogen business model to be funded and delivered on a UK-wide basis. It would be applicable to all low carbon hydrogen production technologies that meet the requisite standard in terms of GHG emissions (which is not the same thing as saying that any project using any technology would be eligible for support). It should assist uptake of low carbon hydrogen across a range of potential energy applications.

BEIS appears to see the business model as essentially a domestic scheme: “exports of hydrogen could be permitted for projects benefiting from business model support, although the specific volumes exported would not be eligible for support payments”. Even in the domestic context, it is also designed to provide support only for production, and not for financing significant distribution or storage infrastructure – although “small-scale hydrogen pipelines and non-pipeline distribution and small-scale storage infrastructure could potentially be factored in as part of projects’ overall costs”.

In principle, if you are seeking to close the price gap between low carbon hydrogen and counterfactual fuels, you could do it by subsidising either producers or end users. BEIS prefers the former as being simpler and less vulnerable to complications on the demand side. It also wants to deliver support through contracts, rather than a “policy-based approach” or economic regulation.

UK public support for renewable electricity generating projects has been through a number of iterations, notably green certificates (ROCs), feed-in tariffs and contracts for difference (CfDs). BEIS is determined that the hydrogen business model should be one that stands the test of time. The BM Consultation states that its design should conform to 10 core principles: promoting market development; promoting market competition; being investable; providing value for money (VfM); reducing support over time; being suitable for future pipeline; being compatible with other hydrogen policies; being technology agnostic; being size agnostic; and avoiding unnecessary complexity.

Mitigating price risk in the hydrogen business model

Many European countries began subsidising renewable electricity generation by paying a guaranteed price per unit of electricity generated. This has the merit of simplicity, and works easily enough if there is already a physically connected, liquid market for the commodity in question (electricity). In a market for low carbon hydrogen which (if it exists) has neither of these characteristics, it is less attractive.

BEIS accordingly rejects the “fixed price” approach. It also rejects the idea of a “fixed premium (over market price)” approach on the grounds of risk of producer overcompensation/lack of VfM. Instead, it proposes a variable premium as the best way of mitigating producers’ price risk.

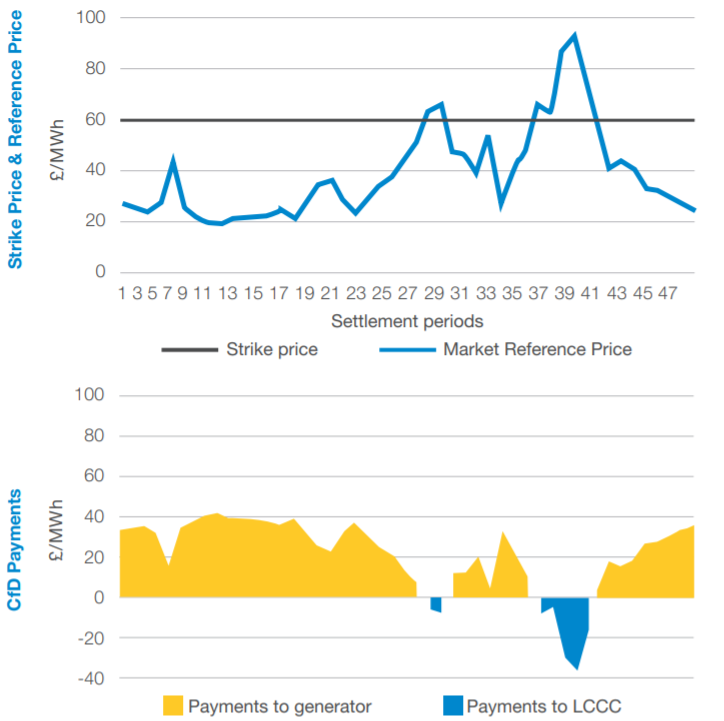

In the renewable electricity world, this has been relatively straightforward to implement – in the UK, as the CfD that supports many GW of generating capacity. For each MW of output, the generator is paid (or makes a payment) based on the difference between a reference price (RP) derived from wholesale market indices and a strike price (SP) set by competitive auction. If SP-RP is positive, the generator is paid by, and if it is negative, it must make a payment to, the CfD counterparty, the Low Carbon Contracts Company (LCCC). The operation of the CfD regime is summarised in the diagram below, taken from LCCC guidance and showing hypothetical changes in the wholesale price of electricity (and therefore the RP) across the 48 half-hourly settlement periods in 24-hour period.

Translating the variable premium approach to the hydrogen context, setting an SP is not difficult in principle. As in the electricity context, it represents the overall value that a producer needs to achieve per unit to cover its fixed and variable costs, financing costs and equity return. The only question is whether you arrive at that figure by BEIS modelling, bilateral negotiations or a competitive process.

The bigger challenge is to decide what the RP should be, since there is not yet a market wholesale price for low carbon hydrogen. Rather, as the BM Consultation points out, the way that BEIS sets the RP will influence price formation in this new market. It goes on to assess seven RP options. It does this in terms of their suitability as proxies for the value of low carbon hydrogen to end users; their ability to promote market development; their likely VfM from BEIS’s perspective; and evolution over time. Crucially, it assesses the options without making assumptions about the level of any other relevant government intervention, such as carbon pricing.

The options rejected (although BEIS finds that even each of these has some advantages) are:

- input energy price: no necessary positive correlation with hydrogen value; nothing to stop overcompensation where producers sell at a high price; no guarantee of reducing subsidy trajectory; may indirectly subsidise the producer’s other operations (by transfer pricing);

- natural gas price: may be an excessive subsidy for sales to users of more expensive fuel; those who pay no carbon price are less incentivised; subsidy may not reduce over time;

- counterfactual fuel prices: take the RP that fits each customer, and each pays the same price as before switching, with a carbon cost saving if they are subject to a carbon price (producers may be incentivised to sell into markets that can absorb highest volumes with least effort, and the incentive to switch is limited to carbon cost savings);

- carbon price: may not perfectly reflect hydrogen market value – or be strongly correlated with production costs, especially for green hydrogen – and the correlation will weaken over time; suitability may depend on contract length; inherently more suited to demand side subsidy;

- natural gas price + carbon price: removes price incentive on industrial users to switch, since their fuel cost would be the same and they still have the capex costs of switching.

BEIS’s favoured RP options are:

- a market benchmark: (i.e. the low carbon hydrogen equivalent of the indices used in renewable electricity CfDs) when this can be robustly and reliably calculated – as such it is the preferred option for future contracts on NOAK projects, but cannot be applied yet;

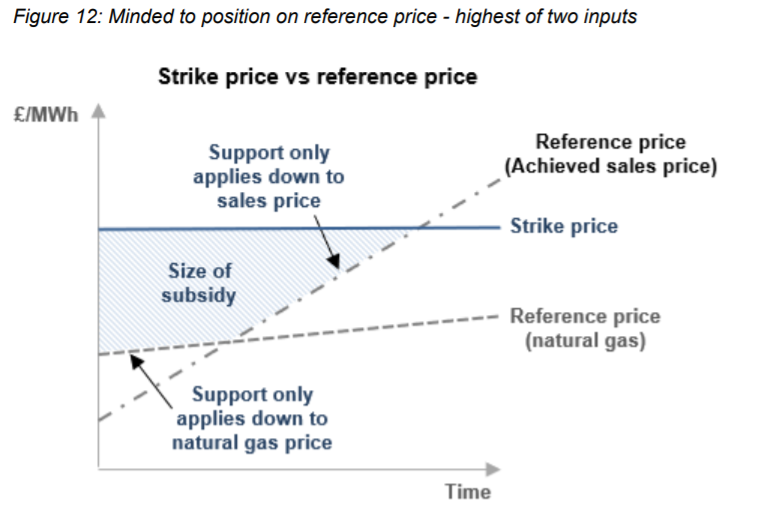

- the price at which the producer sells the unit in question, subject to a floor price set at the natural gas price: this will do until a benchmark is available. The starting point for calculating RP in each case would be the actual sale price, but there would be no additional subsidy for selling a unit at a price below the natural gas price if the achieved sales price is lower than the natural gas price. It is not entirely clear whether the “natural gas price” would be the wholesale price or aim to represent what each end user would pay for gas. In practice, it seems likely that producers may set their prices at, or at least by reference to, a gas price. This, the proposed model for the near term, is illustrated from the BM Consultation below.

It is further proposed that there should be “additional contractual measures, such as a gainshare mechanism or a periodic payment linked to achieving or exceeding a defined pricing threshold or benchmark”. Further work on this is to be “discussed with stakeholders”.

The BM Consultation raises the question of how the SP should be indexed to take account of changes in producers’ costs over time, but it does not reach a conclusion on a particular index, having found something to be said both for and against each of: a general price inflation index; increases in actual energy costs; a natural gas benchmark; and an electricity price benchmark.

Already, we have something that is materially more complex than the renewable support CfD structure, even at an administrative level (given the need to record each transaction and its price, rather than simply metering the export from a generating station). However, as we explain in the next post, there are further complexities to the hydrogen business model to deal with volume risk.